Below you'll find our roundup of the best news and developments across the web, covering everything from real estate highlights to climate change, city developments, and urban planning.

FIN FRONTIERS

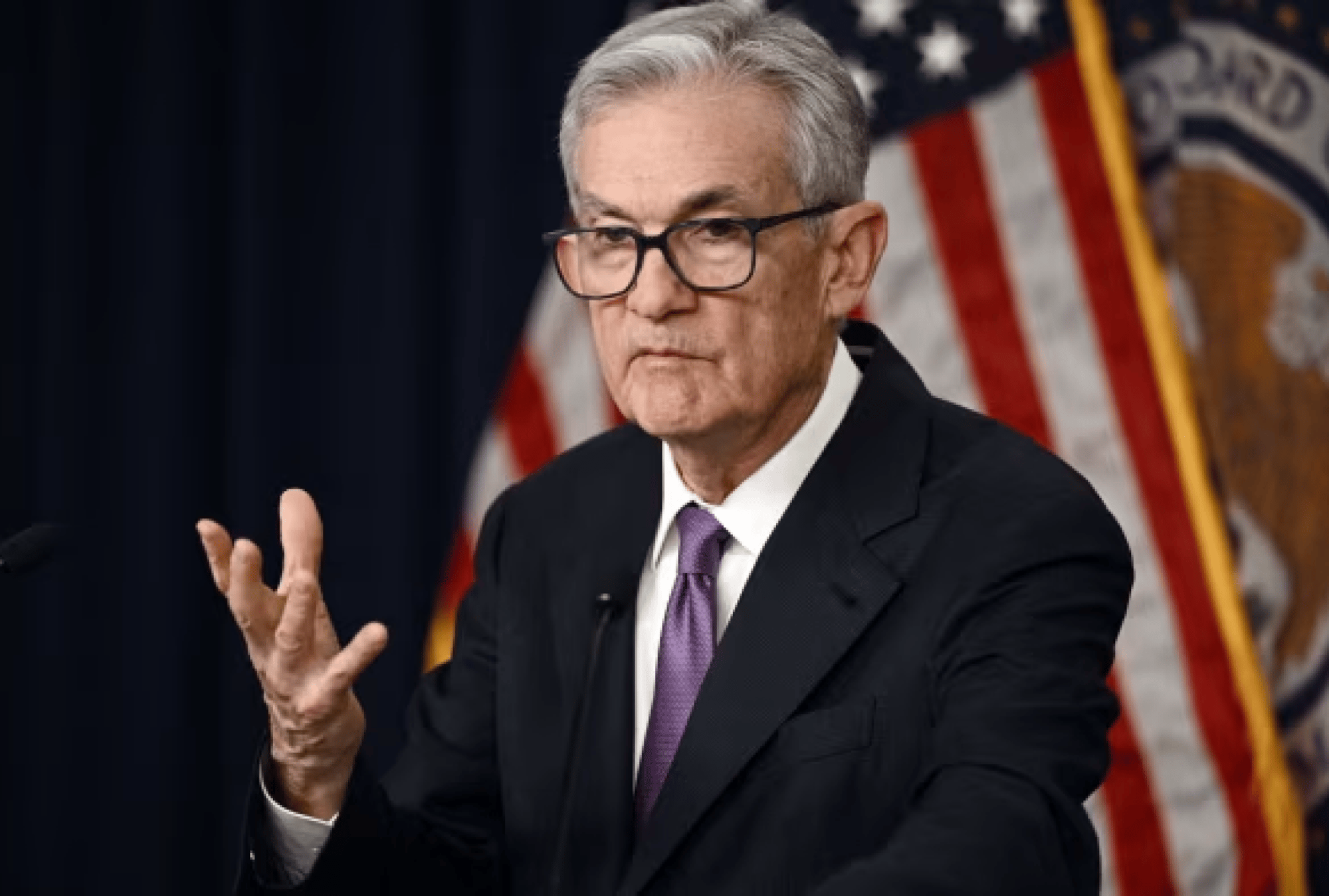

Economy's Edge: Soft Landing's Pledge?

The U.S. economy may achieve a 'soft landing' as the Federal Reserve forecasts a decrease in inflation with minimal job loss or slowdown. However, challenges loom with depleted savings for lower-income households and rising refinancing rates for debt-laden companies. The Fed faces tough choices ahead, balancing inflation reduction with economic stability, as the era of easy monetary policy and minimal trade-offs ends. Read more.

Fed's Hope: A Soft Landing's Scope

If the Federal Reserve's strategy for a 'soft landing' in the economy succeeds, it could lead to more favorable financial conditions. This optimistic outlook hinges on reducing inflation without major job losses or economic slowdown. Will this careful balancing act by the Fed pave the way for economic stability, or are there unforeseen challenges ahead? Read more.

REAL ESTATE HIGHLIGHTS

Housing Halt: Ripple Effects Felt

The U.S. housing market's slowdown, triggered by rising mortgage rates and high home prices, has broadly impacted related industries. The cascading effect reflects the housing market's integral role in the broader economy, highlighting the challenges of decreased home sales. With consumer spending on durable goods declining, industries are adjusting strategies to navigate the current economic landscape. Read more.

Mortgage Shift: Rate's Drift, Market's Lift?

Mortgage rates, influenced by a key spread factor, are now declining after a prolonged high, bringing optimism to home buyers and the housing industry. With the Fed signaling possible rate cuts, there's a resurgence of interest in mortgages. Will this downward trend in mortgage rates continue, revitalizing the housing market and related sectors? Read more.

CRE CORNER

Rental Relief: Market Shift, Tenants' Gift?

In 2023, the apartment rental market eased its relentless rent hikes, a trend likely to continue into 2024. Despite this, the rental market's affordability remains a concern, with many tenants still financially strained. With nearly a million new units under construction and changing economic factors, will this trend bring more balance to the rental market and ease for tenants? Read more.

Retail Revival: Hines' Insight, Market's Bright?

Hines, a prominent real estate firm, views retail as a key investment opportunity for 2024, likely due to evolving consumer trends and market recovery post-pandemic. As the retail landscape adapts to new consumer behaviors and technological advancements, could this mark a resurgence in retail as a lucrative asset class? Read more.

METROPOLITAN MATTERS

Modular Shift: Housing's New Blueprint

Jordan Rogove and Wayne Norbeck argue in The Architect’s Newspaper for simplified building and zoning codes to boost modular housing, making it a viable solution for the housing crisis. The proposed ROAD to Housing Act seeks to modernize these regulations, potentially making modular homes more affordable and accessible. Could these changes in regulation be the key to resolving the housing shortage? Read more.

Congestion Clash: NYC's Toll Turmoil

A teachers union in New York City is suing to block a congestion pricing plan, alleging it will reroute traffic and worsen pollution in certain areas. Critics argue the plan was hastily implemented without adequate environmental review. As the city seeks to become the first major U.S. city with such a charge, will this lawsuit derail its congestion-cutting ambitions? Read more.CLIMATE CHRONICLES

Coastal Crisis: Cities Sink, Risks Brink

Atlantic coast cities in the U.S., like New York and Baltimore, are sinking rapidly, surpassing global sea level rise. New research shows over 2 million people and countless properties are in jeopardy. Key infrastructures, such as JFK Airport, face potential damage. As these cities grapple with sinking land and rising seas, how will they adapt to this growing environmental challenge? Read more.

AI's Green Scene: Climate Solutions Gleam

Artificial Intelligence (AI) is being increasingly used for climate solutions, from detecting methane emissions to early wildfire warnings and green tech mining. This application of AI in environmental sustainability raises a critical question: Will this technological intervention be the key to advancing our fight against climate change and its impacts? Read more.

ALTERNATIVE AVENUES

Forecast Fluctuations: CRE's Future Speculations

Prologis forecasts a dynamic shift in the commercial real estate market for 2024, including a potential doubling in private equity real estate funding driven by declining interest rates and reversing capitalization rate movements. As the commercial real estate landscape braces for these changes, the question remains: Are these bold predictions a clear glimpse into the future or a speculative gamble in an unpredictable market? Read more.

Man Group's Strategic Leap: Private Credit's Deep?

Man Group Plc is branching into private credit, eyeing acquisitions and team expansions to capitalize on the sector's growing appeal. Man Group aims to cater to changing investor preferences and insurance managers' tilt towards fixed-income alternatives. But, can this significant move into private credit mark a transformative era for Man Group in the evolving financial landscape? Read more.INSPIRATION ALLEY

Fungal Futures: Can Mushrooms Shape Our Structures?

Researchers at the University of British Columbia are exploring "engineered living materials" using fungi like oyster mushrooms for sustainable construction. As these living materials develop, they could even filter pollutants like wildfire smoke. This research signifies a groundbreaking shift in building practices, but how will these ecological innovations transform our urban landscapes? Read more.

CAUSE WE SUPPORT

The Global Fund

The Global Fund is a worldwide movement to defeat HIV, TB, and malaria and ensure a healthier, safer, more equitable future for all. This year, the Global Fund is calling on the world to Fight For What Counts and save 20 million lives.

Learn more.

HAVE A GREAT WEEKEND!

To invest and read more about the Sortis Funds, visit our website, or find us on Linkedin. We are happy to answer any questions you may have at dutton.elske@sortis.com.

Some of the content in featured in the newsletter may be behind a paywall and require a subscription to read.

.png?width=119&height=79&name=Untitled%20design%20(2).png)