Below you'll find our roundup of the best news and developments across the web, covering everything from real estate highlights to climate change, city developments, and urban planning.

FIN FRONTIERS

Monetary Moves: IMF's Glimpse, Economy's groove

The IMF unveils insights—75% of U.S. monetary shifts have played out, signaling a unique dance with resilience. As the euro zone awaits its turn, explore the intricate web of global economic choreography. Will this script lead to a soft landing, or are twists ahead? Read more.

Tax Talks and Economic Walks: Fiscal Boost or Inflation Strain?

US lawmakers mull a $70 billion tax deal, providing potential fiscal relief. Yet, the dual-edged sword—boosting spending but fueling inflation—complicates the Fed's rate-cutting prospects. As negotiations unfold, will the tax tonic drive economic vigor or inflation's rigour? Read more.REAL ESTATE HIGHLIGHTS

Redfin Finds: Despite Rates, Homeowners Eye Sales

Despite the challenging rate landscape, a Redfin study reveals a slight dip in the share of homeowners with low rates. From a peak of 92.8% in mid-2022, it dropped to 88.5% in Q3 2023. Factors like major life events prompt some to sell, challenging the "lock-in" effect. Read more.

US Home Construction Takes a Dip, Will It Regain Its Grip?

CRE CORNER

Mall Depart, Shoppers Chart: Retailers Choose to Part

Retail giants, including Bath & Body Works and Foot Locker, are ditching malls for open spaces, driven by cost savings and improved performance. As malls struggle with declining foot traffic, will they evolve or succumb to the shopping revolution? Read more.

Real Estate Rethink: Alternatives Ascend, Portfolios Transcend

FT examines a significant trend in commercial real estate. Uncover the details and implications of this evolving market. Are investors adapting to new strategies in property investment? Read more.

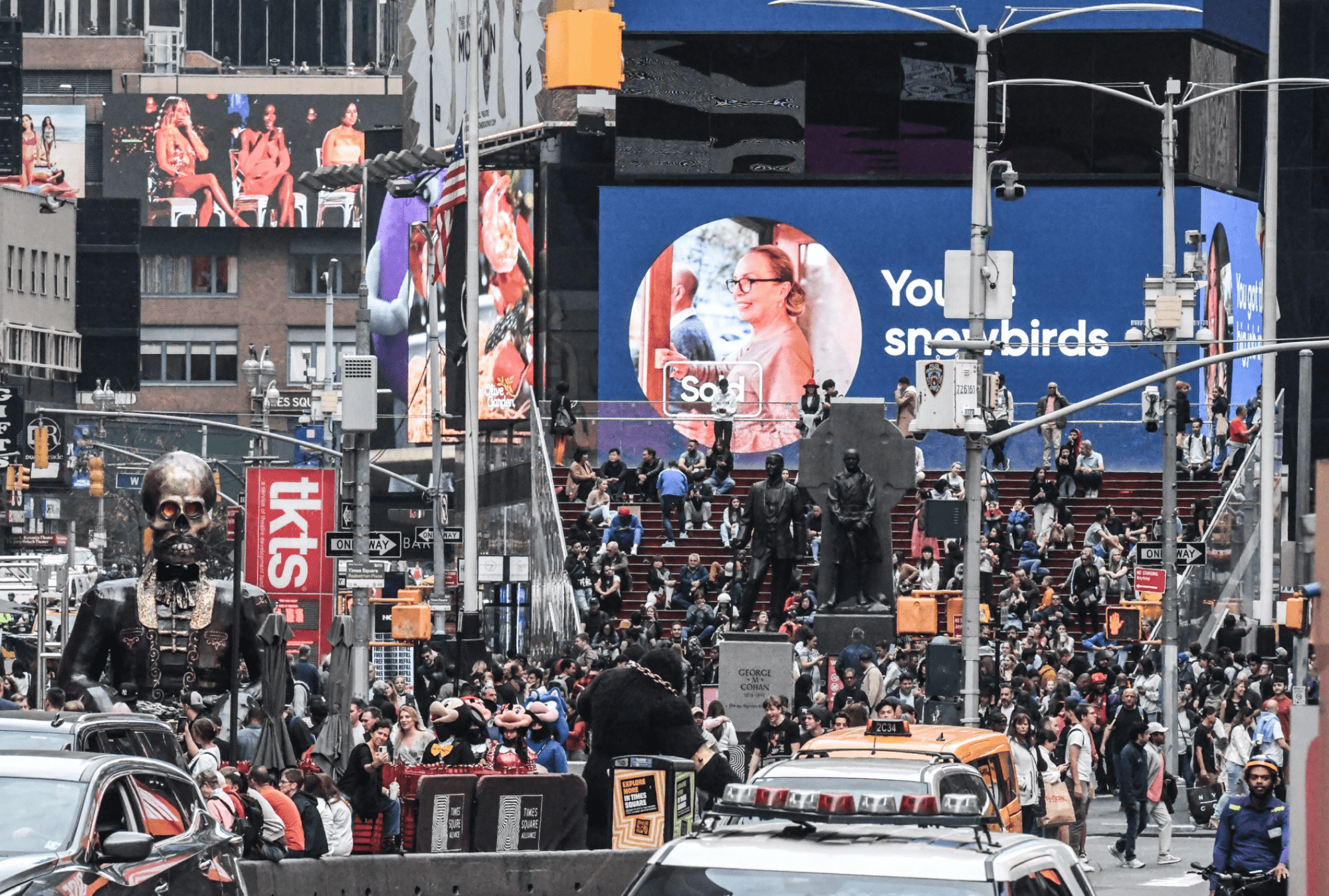

METROPOLITAN MATTERS

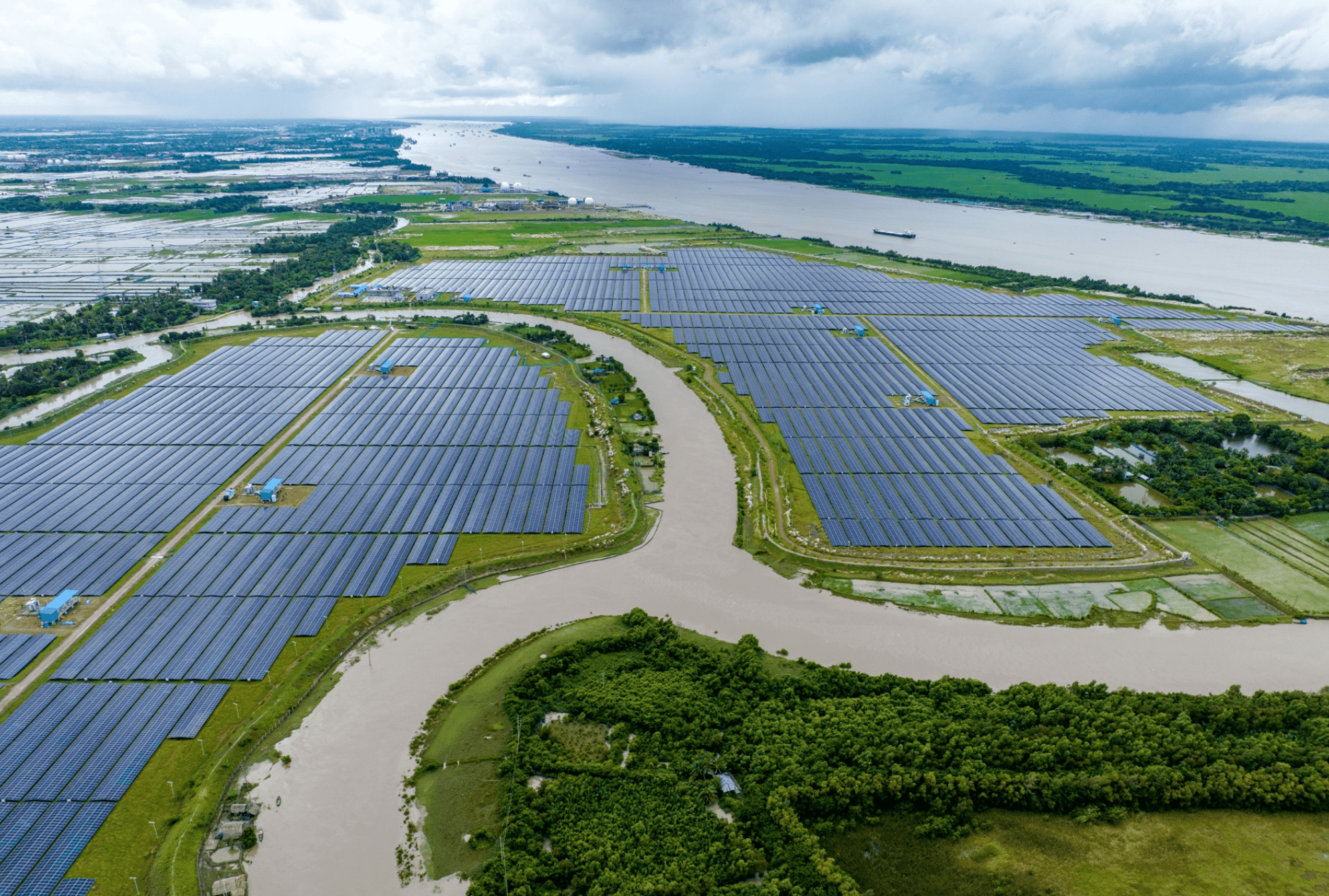

Renewables' Quest: A Future Unaddressed?

A report warns of a 42% renewable energy gap by 2050, urging swift AI-driven interventions and collaborative measures. Can businesses embrace these changes to bridge the gap and meet climate goals? Read more.

Komma's Kommutation: A Revolution in Urban Mobility?

Former Ferrari-designer Lowie Vermeersch envisions a shift with start-up Komma, presenting a covered, electric two-seater with a motorcycle's width. Aimed at reshaping urban mobility, can Komma spark a positive evolution by using fewer resources and advocating for diverse transport modes? Read more.

CLIMATE CHRONICLES

Boston's Climate Quest: UNESCO Sites Put to Test

Boston's Museum of Science unveils "Changing Landscapes," a hands-on exhibit simulating climate threats to UNESCO sites. Can this interactive experience spur action on climate change? Read more.

Climate Clarity: Not the End of the World

Explore the bright side of environmental progress in "Not the End of the World" by Hannah Ritchie. With a fact-rich narrative, the book dispels climate myths, offers solutions, and emphasizes human agency. Can this positive outlook inspire action amid global challenges? Read more.

ALTERNATIVE AVENUES

Credit Flow Go: Surge in Secondary Show

Investors aim to cash out $30 billion in private credit stakes this year, driven by liquidity needs. Europe sells, the Middle East buys. Will this reshape credit dynamics, impacting global investment plays? Read more.

Investing Insights Take New Flights: CAIA’s Alternative Approach

CAIA revamps its Fundamentals of Alternatives program, urging wealth advisors to view alternatives not as add-ons but as integral long-term strategies. As retail investors embrace alternative products, will this reshape how advisors approach and integrate these diverse investment options? Read more.

INSPIRATION ALLEY

Urban Farm Charm: CAIA's Alarming Reform

CAIA redefines urban agri-wisdom; will advisors now see city farms as vital to the portfolio's charm? Read more.

CAUSE WE SUPPORT

The Global Fund

The Global Fund is a worldwide movement to defeat HIV, TB, and malaria and ensure a healthier, safer, more equitable future for all. This year, the Global Fund is calling on the world to Fight For What Counts and save 20 million lives.

Learn more.

HAVE A GREAT WEEKEND!

To invest and read more about the Sortis Funds, visit our website, or find us on Linkedin. We are happy to answer any questions you may have at dutton.elske@sortis.com.

Some of the content in featured in the newsletter may be behind a paywall and require a subscription to read.

.png?width=119&height=79&name=Untitled%20design%20(2).png)