Below you'll find our roundup of the best news and developments across the web, covering everything from real estate highlights to climate change, city developments, and urban planning.

FIN FRONTIERS

Bond Battles: Fiscal Fears, Market Cheers

Rate Reshuffle: CFOs' Cautious Optimism

A survey involving 443 CFOs by Duke University and the Federal Reserve reveals an expectation of slightly higher refinancing costs in 2024-2025, with a subsequent decrease. Optimism grows despite short-term fiscal strains, as borrowing costs are predicted to moderate. This reflects a balance between immediate financial challenges and long-term economic positivity, indicating a cautiously optimistic business outlook for the near future. Read more.

REAL ESTATE HIGHLIGHTS

Housing Hopes: A Market Thaw? | Will Trends Turn?

The U.S. housing market shows signs of revival as mortgage rates dip below 7%. However, the market's future remains uncertain with a significant number of contract cancellations and economic instability influencing buyer and seller decisions. Will these positive trends continue into 2024, reigniting the housing market? Read more.

Building Boom: A Housing High? | Is Revival Nigh?"

CRE CORNER

Retail Revival: A Market Shift?

Big investment firms are revisiting retail real estate, attracted by its resilience and strong recent performance. The shift comes as remote work diminishes demand for office spaces. The sector's fundamentals, strengthened by limited new construction and low vacancy rates, are drawing attention, raising the question: Is retail real estate poised for a significant rebound? Read more.

Real Estate Rebound: PwC's Positive Prediction - A Market Revival?

Morgan Stanley is seizing opportunities in the distressed global commercial-property market, targeting diverse investments like apartments and industrial properties. This proactive approach is especially focused on the U.S. and Japan, expecting quick market corrections and recoveries. Read more.

METROPOLITAN MATTERS

Urban Renewal: Woodlawn's Rise & A Model for Future Cities?

Chicago's Woodlawn neighborhood is undergoing revitalization through the Park Station project aimed at expanding mixed-income housing and rejuvenating the community. Park Station's design integrates commercial spaces and access to public transport, aligning with the city's vision of fostering sustainable, inclusive communities. Could this be a blueprint for revitalizing other urban areas? Read more.

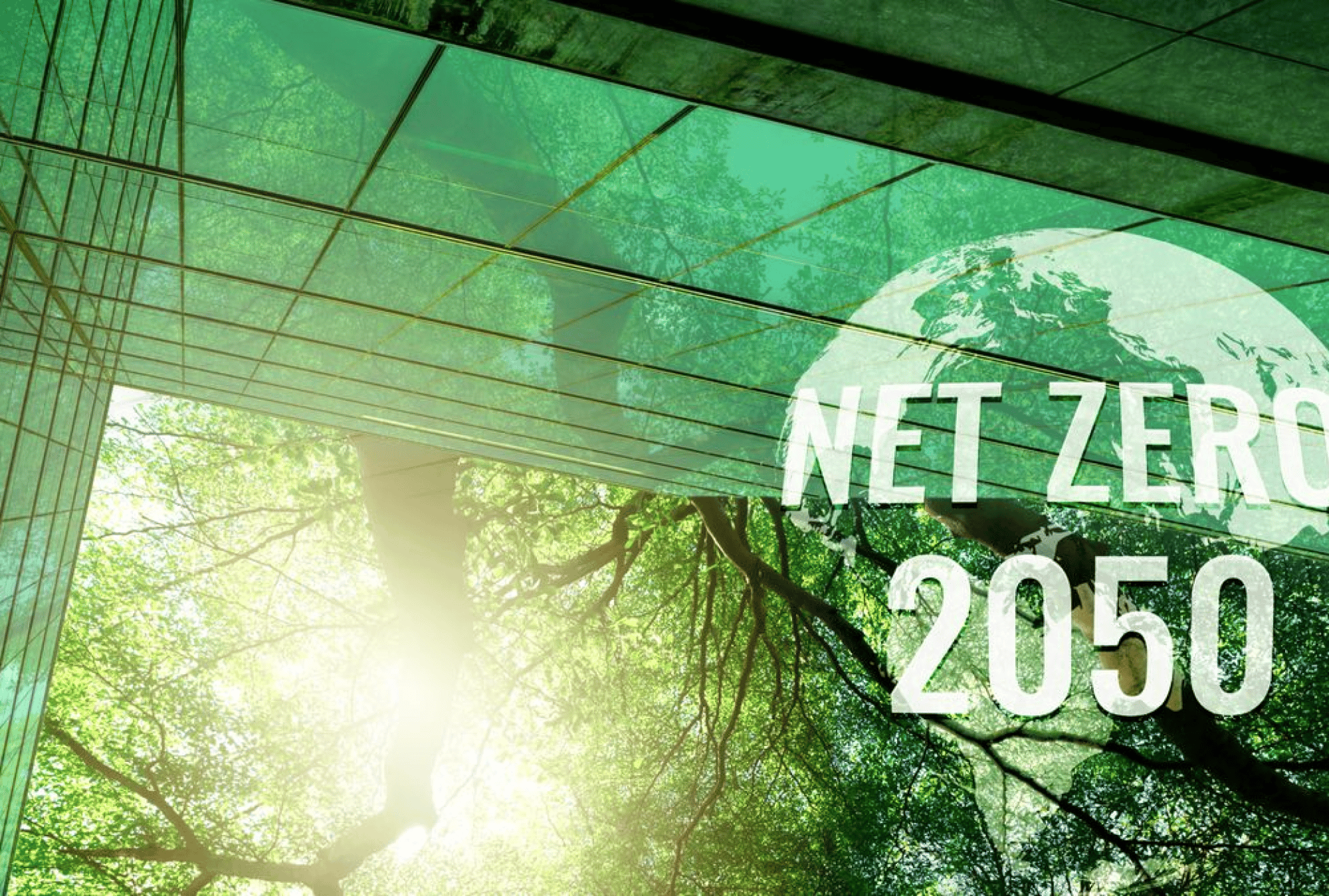

Net-Zero Nexus: Building a Greener Future

The WBCSD's report on net-zero operational carbon buildings highlights the need for a globally consistent definition of net-zero buildings. With imminent regulatory changes, property managers face challenges in aligning with these evolving standards while meeting immediate tenant and investor needs. Could this drive a sustainable transformation in the real estate sector? Read more.

CLIMATE CHRONICLES

Flood Flight: Future Plight in Sight?

The First Street Foundation report shows 3.2 million Americans moved due to flood risks, identifying "climate abandonment areas." Most affected are Sun Belt states like Florida and Texas. Midwest and Northeast also face future climate migration risks, despite their less apparent appeal compared to coastal cities. The study highlights the economic and insurance impacts of this trend, with nearly 36 million U.S. properties facing higher insurance costs due to climate risks. Read more.

Green Goals: A Latin Leap Building a Sustainable Sweep?

The seminar in Bogotá focused on sustainable and NetZero buildings in Latin America, emphasizing energy efficiency, sustainable construction, and government policies. Key discussions included advancements in the timber industry and the importance of certifications and integrated design for combating climate change. Read more.

ALTERNATIVE AVENUES

Credit Chase: Pension Funds Race Into Private Space

U.S. state and local retirement funds are increasingly investing in private credit, seeking higher returns.This shift is driven by the retreat of banks from riskier lending and the attractive yields of private credit. Key players like CalPERS and the Chicago Teachers' Pension Fund are actively boosting their private debt investments, indicating a growing trend in this asset class.

Read more.

Allocation Evolution: Trending Transformation

The 60/40 asset allocation strategy, though strained in 2022, is evolving with a growing interest in alternative investments. Advisors are increasingly incorporating private equity, venture capital, and private credit into client portfolios, aligning them within traditional equity and bond allocations. The rise in evergreen funds, preferred for their accessibility and simplified tax reporting, marks a notable trend, especially in private equity, suggesting a significant shift in investment strategies for 2024 and beyond. Read more.

INSPIRATION ALLEY

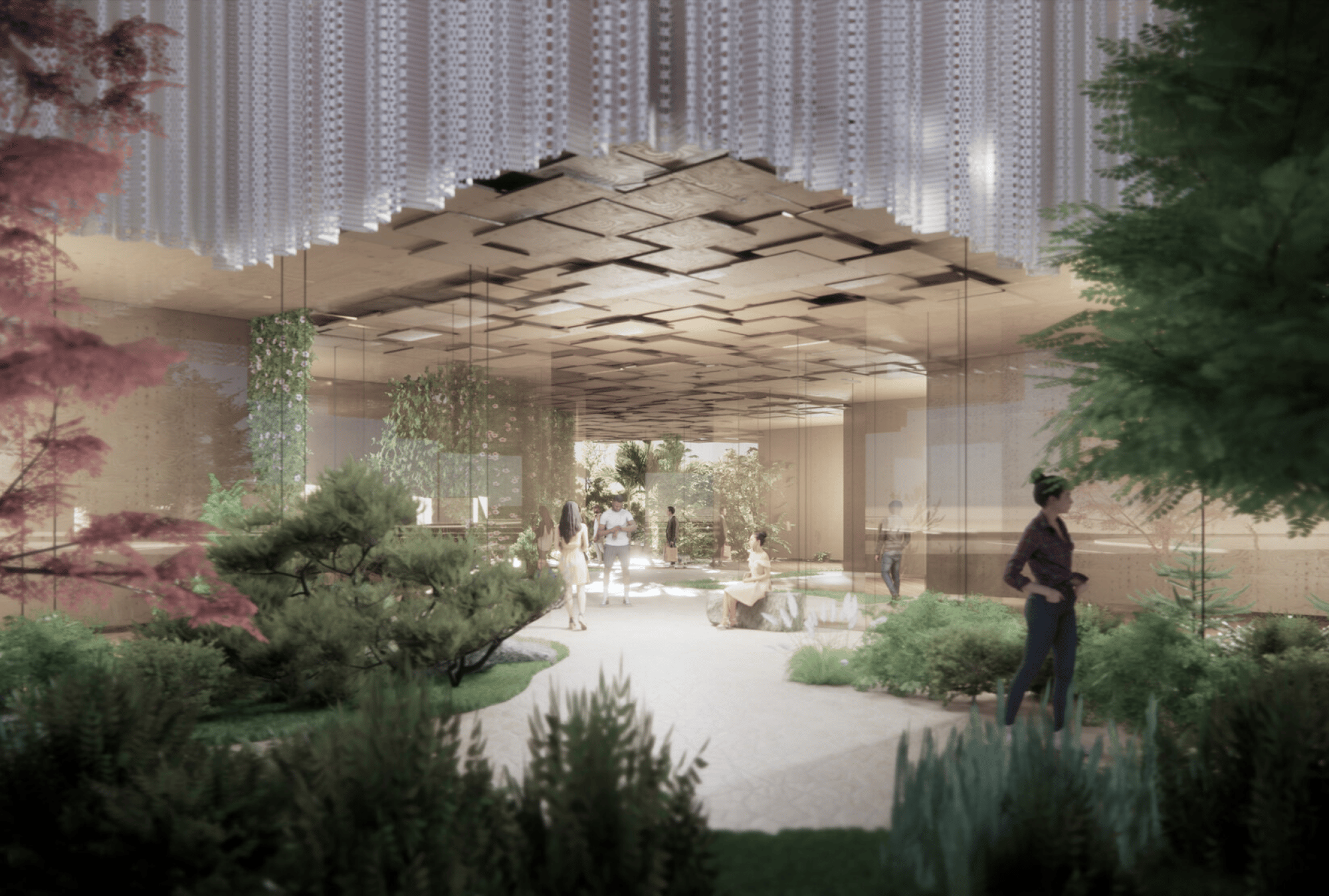

Miami's Future Fusion: A Visionary District's Transformation?

Kengo Kuma and Associates have unveiled "MIRAI Design District," their first mixed-use project in the U.S., in Miami, Florida. Integrating technology and sustainability, it includes high-tech lobbies, operable windows, and a green roof with solar panels. The design emphasizes a blend of Floridian and Japanese elements, aiming to become a cultural hub in Miami’s Design District with its unique retail, art, and social experiences. Read more.

CAUSE WE SUPPORT

The Global Fund

The Global Fund is a worldwide movement to defeat HIV, TB, and malaria and ensure a healthier, safer, more equitable future for all. This year, the Global Fund is calling on the world to Fight For What Counts and save 20 million lives.

Learn more.

HAVE A GREAT WEEKEND!

To invest and read more about the Sortis Funds, visit our website, or find us on Linkedin. We are happy to answer any questions you may have at dutton.elske@sortis.com.

Some of the content in featured in the newsletter may be behind a paywall and require a subscription to read.

.png?width=119&height=79&name=Untitled%20design%20(2).png)