Overview

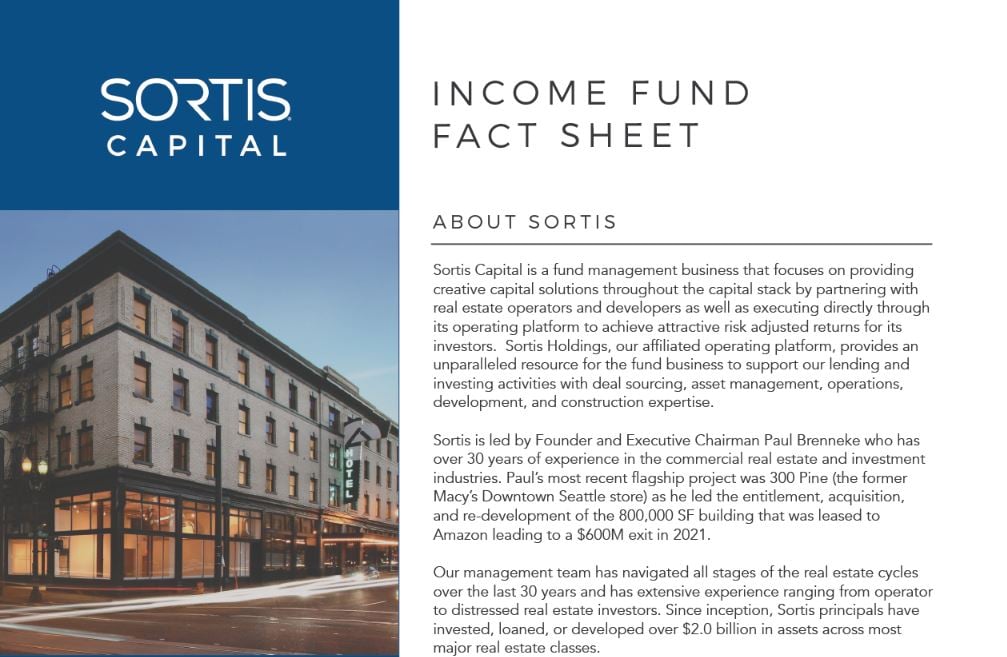

Sortis sponsors and manages the Sortis Income Fund (“SIF”), an un-leveraged, evergreen investment fund focused on the acquisition of senior loans collateralized by real estate in Western US markets. SIF’s disciplined approach and rigorous risk management results in a diversified loan portfolio generating stable, high yielding fixed-income returns for investors, all without the use of leverage.

Sortis’ real estate and banking expertise allows SIF to selectively deploy capital in an environment where high demand for financing is not being met by traditional financial institutions. Equity membership units in the fund are offered to Accredited Investors through a Regulation D private placement securities offering.

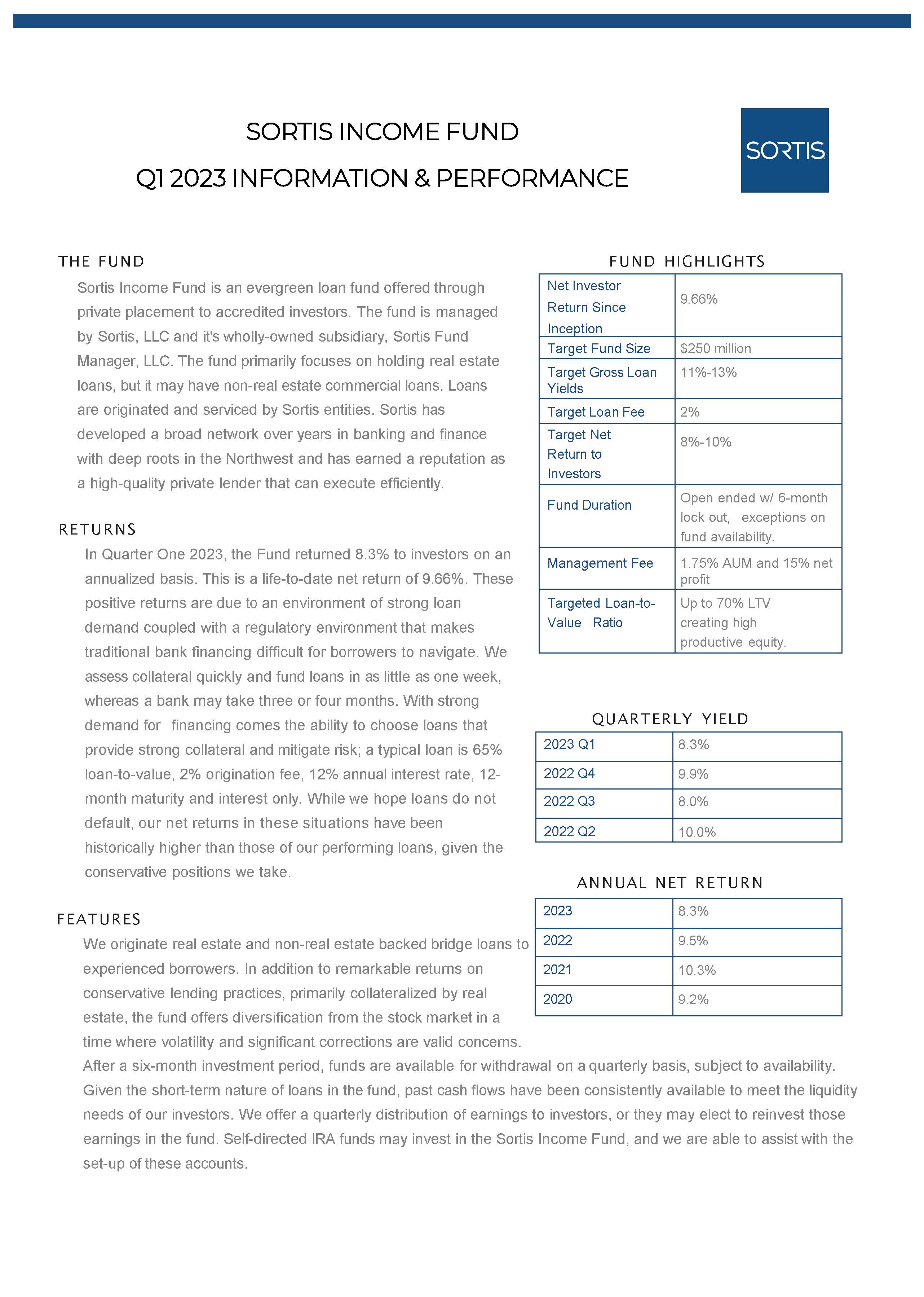

Offering Type Credit Fund - 1st Lien

Investor Target IRR 8% - 10%

Cash-on-Cash Yield 10% - 12%

Investment Period 6+ Months

Minimum Investment $50,000

Offering Type

Investor Target IRR

Cash-on-Cash Yield

Investment Period

Minimum Investment

Credit Fund - 1st Lien

8% - 10%

10% - 12%

6+ Months

$50,000

Fund Documents and Information

May 2023 - The State of Commercial Real Estate

A comprehensive analysis by Sortis Founder, Paul Brenneke of the impact rising rates have on alternative asset markets, with a particular focus on commercial real estate.

Click below to watch the May 2023 webinar, presented by Paul Brenneke,

Highlighted Transactions

.png?width=119&height=79&name=Untitled%20design%20(2).png)