Overview

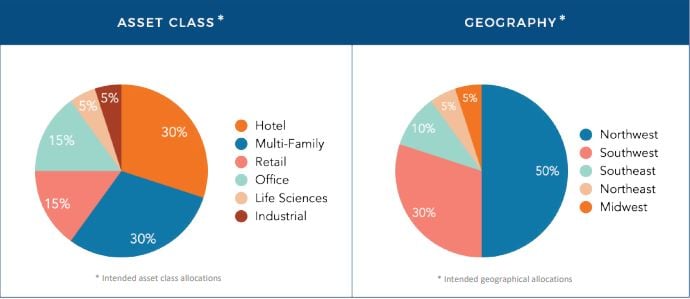

Sortis sponsors and manages the Sortis Real Estate Investment Trust (“Sortis REIT”), a non-traded perpetual real estate investment trust focused on the acquisition of core and core plus real estate assets. The Sortis REIT uses creative sourcing and hands-on management resulting in a diversified asset portfolio generating stable cash flows with longterm appreciation. The private REIT vehicle allows Sortis to provide cash flow in a tax advantageous manner and allow exposure to real estate equity as a hedge to inflation.

Equity shares in the fund are offered to Accredited Investors through a Regulation D private placement offering in a non-traded perpetual real estate investment trust vehicle.

Fund Documents and Information

May 2023 - The State of Commercial Real Estate

A comprehensive analysis by Sortis Founder, Paul Brenneke of the impact rising rates have on alternative asset markets, with a particular focus on commercial real estate.

Click below to watch the May 2023 webinar, presented by Paul Brenneke,

.png?width=119&height=79&name=Untitled%20design%20(2).png)